will capital gains tax rate increase in 2021

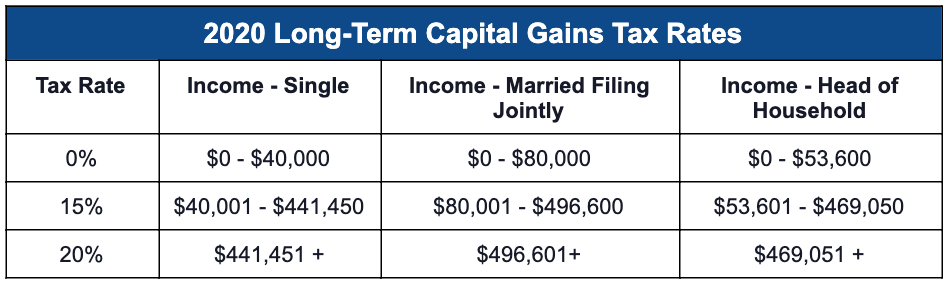

Over the 20202021 tax year the basic rate on. In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing married filing jointly.

How Are Capital Gains Taxed Tax Policy Center

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

. The effective date for this increase. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Tax-free exchange is a tax deferred exchange in which one pays capital gains taxes for exchange of a property not when the transfer takes place but on a later date.

Those tax rates for long-term capital gains are typically much lower than the ordinary tax rates youd otherwise pay which currently can be as high as 37. A summary can be found here and the full text here. Basic rate payers and higheradditional rate payers.

President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after. Rishi Sunak will increase rate to 28 percent CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh. First deduct the Capital Gains tax-free allowance from your taxable gain.

In fact recent intelligence suggests many Democrats favor a rate increase as low as 42 percentage points which would result in a 242 rate before net investment income. The Times reports that the Chancellor is considering an increase in the dividend tax rate by 125 and a cut to the 2000 tax-free dividend allowance perhaps halving it. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Capital gains tax warning. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high as 28. Private Wealth Services Partner Christopher Boyett was quoted in a Bloomberg article on President Joe Bidens expected proposal to nearly double the capital gains tax rate.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9. CGT rates differ from income tax rates and are in two broad brackets. However it was struck down in March 2022.

Long-term capital gains are incurred on appreciated assets sold after. The proposal would increase the maximum stated capital gain rate from 20 to 25. In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis.

The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20. Add this to your taxable. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate.

If your ordinary tax rate is lower than 28. If your taxable income was 45000 and youre filing as a single person youd pay tax at a rate of 22 on that 2000 in gains for a total tax bill of 440 on your short-term gains. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

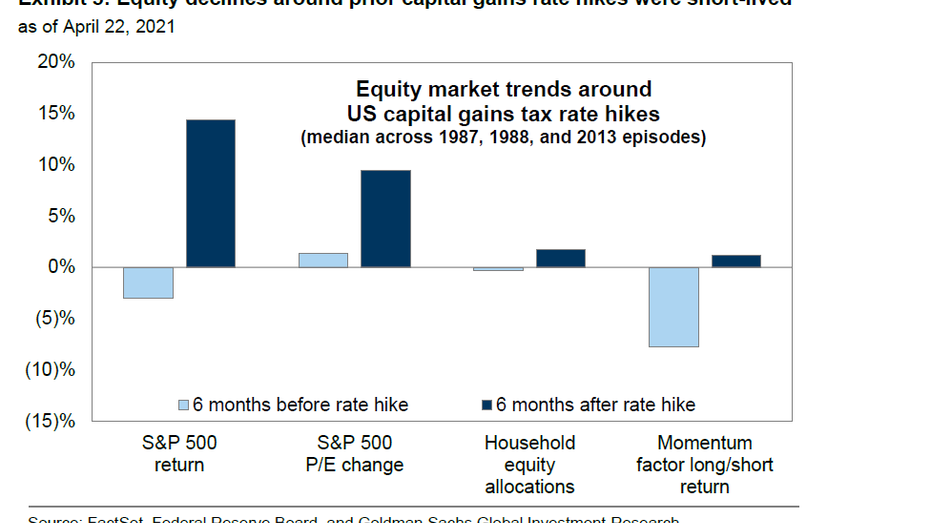

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

The Tax Impact Of The Long Term Capital Gains Bump Zone

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

State Taxes On Capital Gains Center On Budget And Policy Priorities

Potential Increase In Capital Gains Tax Drives Business Owners To Seek Timely Exits Fe International

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

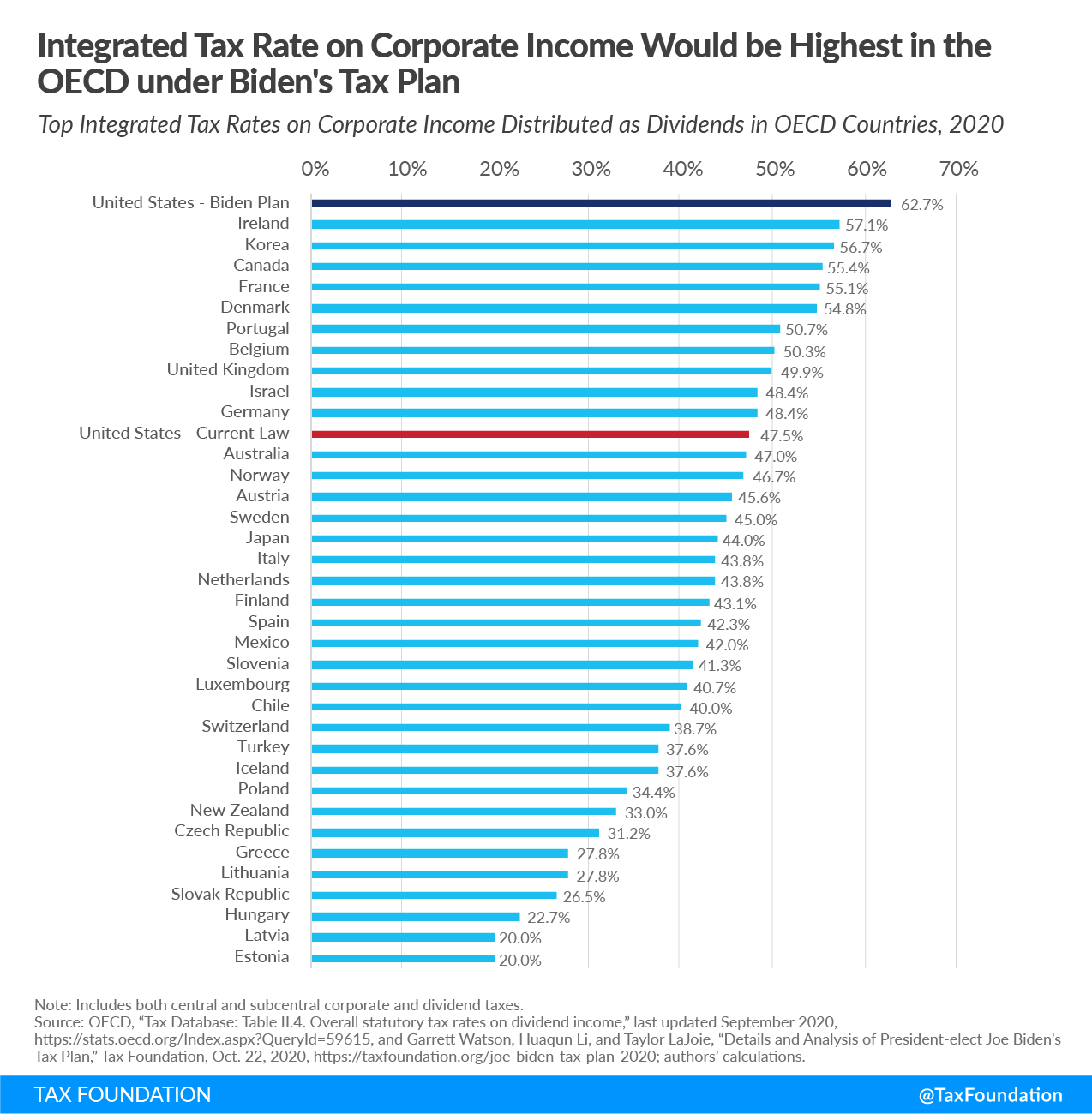

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

September 13 2021 Update Democrats Propose New Tax Increases Srs

How Are Capital Gains Taxed Tax Policy Center

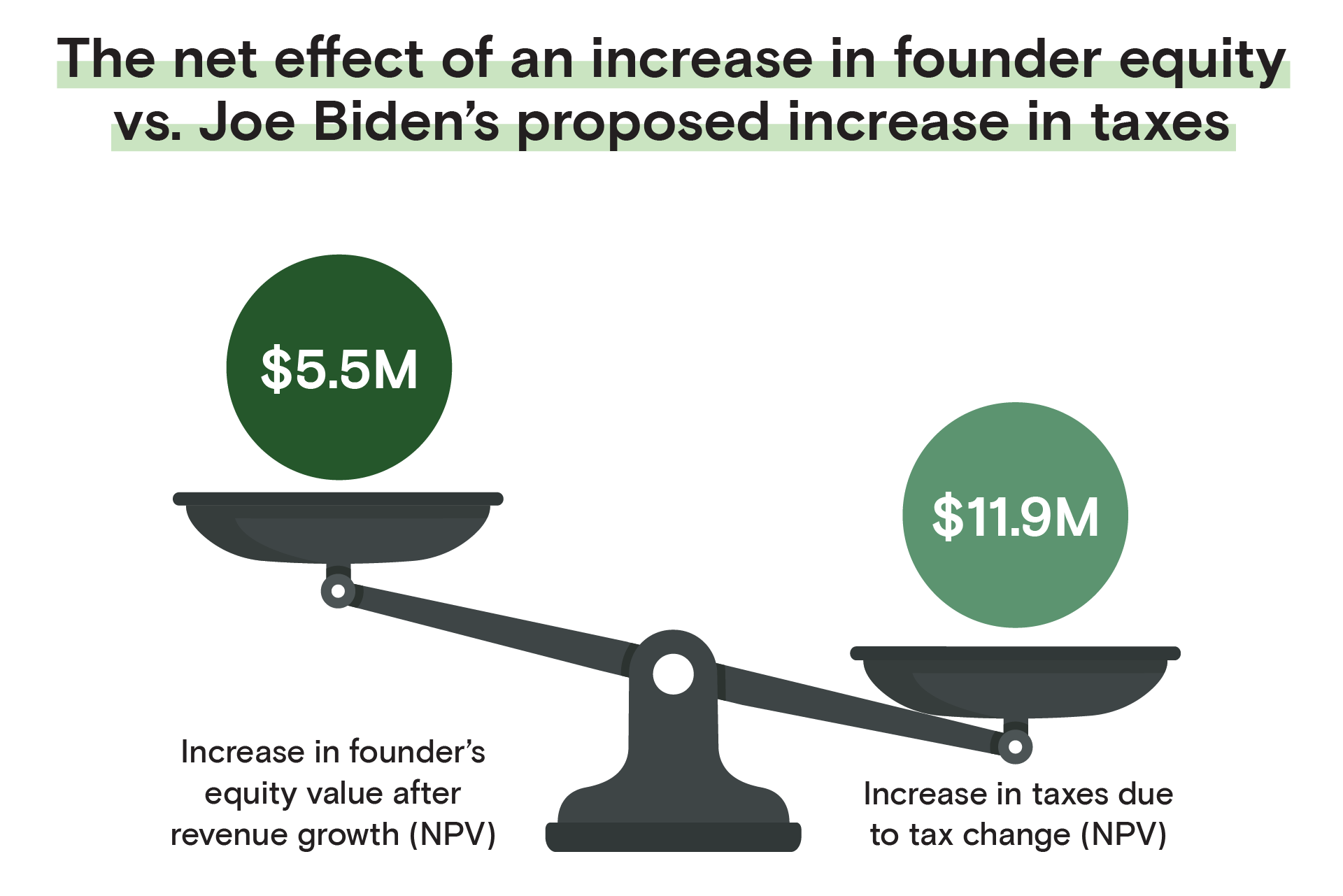

For Founders The Implications Of Joe Biden S Proposed Tax Code

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top

Effects Of Changing Tax Policy On Commercial Real Estate

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Capital Gains Tax Hikes And Stock Market Performance Fox Business

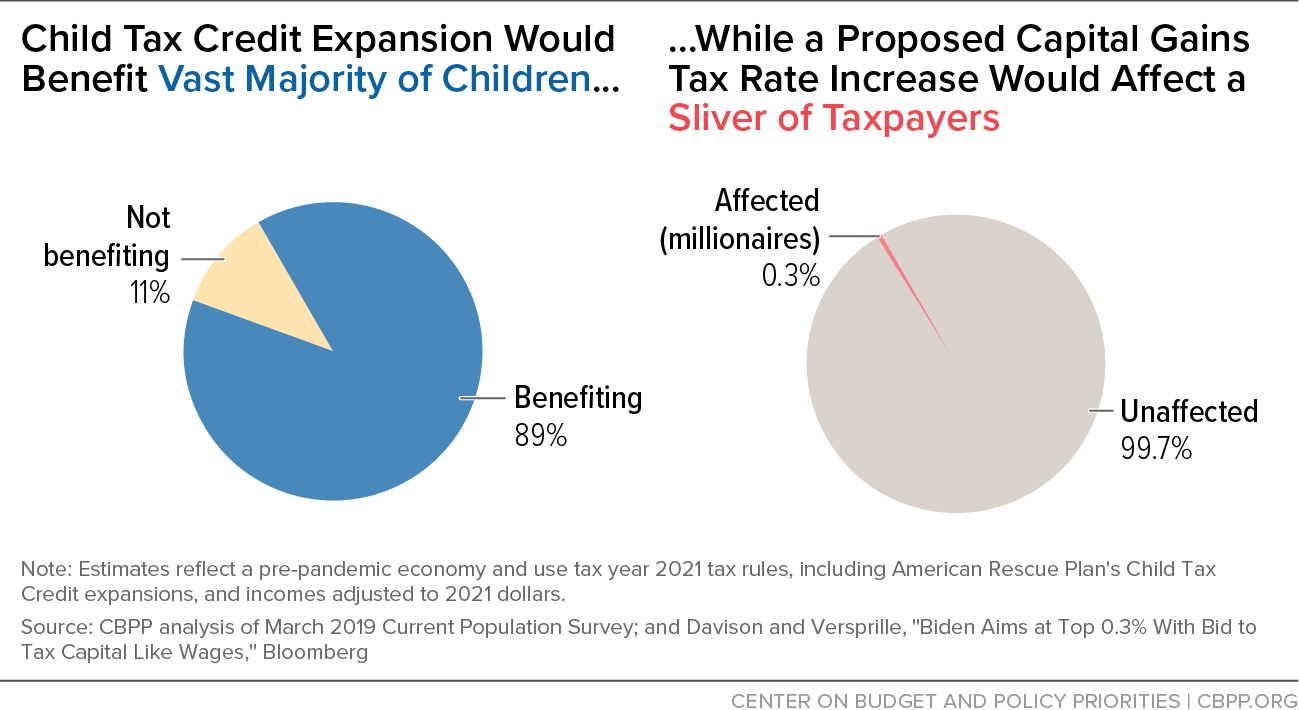

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities